Crypto Trading Journal Review: CMM vs. TMM

Crypto trading is High Risk, High Reward game...

A crypto trader can earn thousands of dollars or lose them in a matter of minutes. Therefore, using the best crypto trading tools is recommended for professional crypto day-trading, especially with a growing portfolio.

In this case, you’ll need to search for the best crypto portfolio tracker that can help you in your crypto trading journey.

What is a Crypto Trading Journal?

Simply put, a crypto trading journal, sometimes called a trading diary, is the history and the reasons behind all your trades, including your thoughts that might have affected your decisions.

Crypto trading becomes guesswork or gambling if you don’t use crypto charting tools, crypto technical analysis, or at least a free trading journal. Worst-case scenario: You can suffer from a losing streak and blow your entire portfolio because of a lack of strategy, impulsive rage-trading, and FOMOing on hyped cryptocurrencies.

Benefits of Using a Crypto Trading Journal

Crypto trading is all about planning, strategizing, generating insights, acting based on data, and being consistent. Now, if you’re still studying how to trade cryptocurrency, a free crypto trading journal:

- Increases your critical analysis before pursuing potential trades

- Allows you to assess your performance and growth objectively

- Generates useful insights about your weaknesses and strengths

- Prevents your emotions to affects your trading decisions

- Keeps you accountable and strategic through concrete data

Traders use a crypto trading journal to record data and analyze them to improve their strategies over time.

But how exactly?

How to Use a Crypto Trading Journal

If you’re just starting out, you can use pen-and-paper or an Excel sheet to track all your trades. An easy way to do this is by making a table for your:

- Entry Date

- Crypto Symbol Pair

- Entry Price

- Take-Profit Level

- Stop-Loss Level

- Profit or Loss

- Profit/Loss Percentage

- Reason/Notes

After each trade, you should enter the result in either the Profit or Loss section and write down the reason/s behind your win or loss. Change the color of each row to indicate if it’s a win (green) or a loss (red).

In some cases, a crypto trading journal can also include a diary section of sorts, where you can write down your emotions, ideas, or thoughts.

Choosing the Best Free Crypto Trading Journal

While many crypto traders started journaling their trades in a spreadsheet, it can rather become cumbersome once your portfolio continues to grow over time. If you’re making several trades per day, it’s easy to lose track or get confused, leading to inconsistent or faulty data.

When this happens, switching to a free crypto trading journal is the best course of action. Many websites or providers are now offering a free crypto trading journal software, which automates the entire process of journaling.

Some are useful, and some are downright trash. So, to help you in your search, we’re going to review two of the best platforms that offer a free trading journal service.

The best crypto trading journal in the market today are:

TraderMake.Money (TMM)

With its motto: Record. Analyze. Profit., Trader Make Money stands out from the rest because of its user-friendly, intuitive interface and versatile analytics features. Although it’s relatively new, it has quickly gained popularity among crypto traders because of its continuous efforts to innovate the features and functionality of the platform.

Coin Market Manager (CMM)

It’s an automated portfolio manager and trading analytics software that can provide useful statistics based on your trading history. It provides many useful features and capabilities that can increase the profitability of professional traders.

So, which crypto trading journal is the best for you? Each of these criteria contributes to the overall performance of a crypto trading journal:

- Features and Capabilities

From a cryptocurrency trading chart to advanced crypto technical analysis, the best crypto trading journal should be able to help you increase the profitability of each trade.

- Widgets and Customization

Not all traders are the same. Each one has a specific strategy in trading, which requires a personalized crypto trading journal. Therefore, the best crypto trading journal should allow full customization of analytics tools.

If you consider this as a crucial factor in your crypto trading journey, TMM is the right crypto trading journal for you. It offers a Summary page with a fully customizable analytics dashboard. Here, you can add over 60 types of widgets and relevant filters, which include charts, numeric widgets, and calendars. Each widget can also be configured based on relevant filters.

On the other hand, CMM offers a pre-calibrated “Math Lab”, where traders can conveniently input data and calculate trades. It also has a screenshot crypto charting tool that can be attached to each trade.

- Intuitive Journal Trades List

Given a large portfolio, the best crypto trading journal should help the trader easily navigate through the endless rows of data. An intuitive trades list should have these must-have features:

- Filters

If you’re still studying how to day-trade cryptocurrency, using filters is a useful skill to master to reduce clutter in your trades list.

Fortunately, both TMM and CMM present data on a spreadsheet-type list, where you can filter trades by any necessary parameters, such as the dates of the trades, duration, net profit, ticker, leverage, volume, keywords for entry reasons, etc.

- Assistive Features

Not all crypto traders are tech-savvy. Some crypto traders may find it hard to understand or navigate some parts of the software. If you agree with this, you should choose a crypto trading journal that includes assistive features.

In this case, TMM comes out on top because it has an assistive “Question” feature, which defines what each column does. You just need to hover on the question mark icon to let the pop-up definition appear.

- Categories and Archives

Sometimes, a crypto trader makes test trades when trying new strategies or implementing some theories.

An intuitive crypto trading journal should allow the trader to compile these types of trades in a special category or archive so that they won’t be taken into account when the software calculates the trade stats.

If this sounds cool to you, TMM is your crypto trading journal of choice. On the other hand, CMM also has a “tag” feature to group trades based on their tags.

2. Chatbots and Integrations

Aside from the features inside the trades list, you should also consider its integrations with other platforms.

A good example is TMM’s Telegram cryptocurrency trading bot; a notification system integrated into each member’s Telegram account. Once integrated into a Telegram account, it can notify the member about orders, closed trades, and profits, show daily and weekly reports, and share open positions with other Telegram users.

CMM has cool sharing features as well, where users can share their live read-only account data by copy-pasting a custom URL or by sharing on Twitter.

3. Risk Management

Every trader is doomed without a risk management protocol in place. One can easily drown and engage in rage trading when experiencing a bad day in crypto trading.

Therefore, the best free crypto trading journal should be able to prevent you, at least to the extent of its control, from blowing your entire deposit or portfolio.

In this case, TMM has a risk management protocol in place for each trade, deposit, and leverage trade. In its Risk Management Section, you can set recommended parameters, highlighting transactions in red if you violate one of them. TMM’s Telegram Bot will also remind you if you reach your limits. Moreover, all your red transactions will be recorded on the Log of Violations to remind you of your past transgressions.

On the other hand, CMM doesn’t have a risk management feature.

4. Compatibility with Crypto Exchanges

This part is crucial for an advanced crypto trader, especially when you’re trading on multiple crypto exchanges. With this feature, a trader can do multiple things at once. You can do Binance portfolio tracking and then quickly switch to analyzing trades from Deribit.

Since TMM is relatively new compared to CMM, you can see that it has fewer compatible crypto exchange platforms. However, TMM has an instant synchronization feature with the exchange even for free accounts, unlike CMM which requires manual entering of data.

- TMM is compatible with Binance, Binance Futures, Bybit, and FTX

- CMM is compatible with Bybit, Binance, BitMEX, Deribit, Bittrex, FTX

5. Pricing and Packages

When choosing the best free trading journal, price is definitely a factor that many traders consider. So, when selecting the best crypto trading journal, always look for the free version and try the platform first before investing any amount.

CMM also offers three packages:

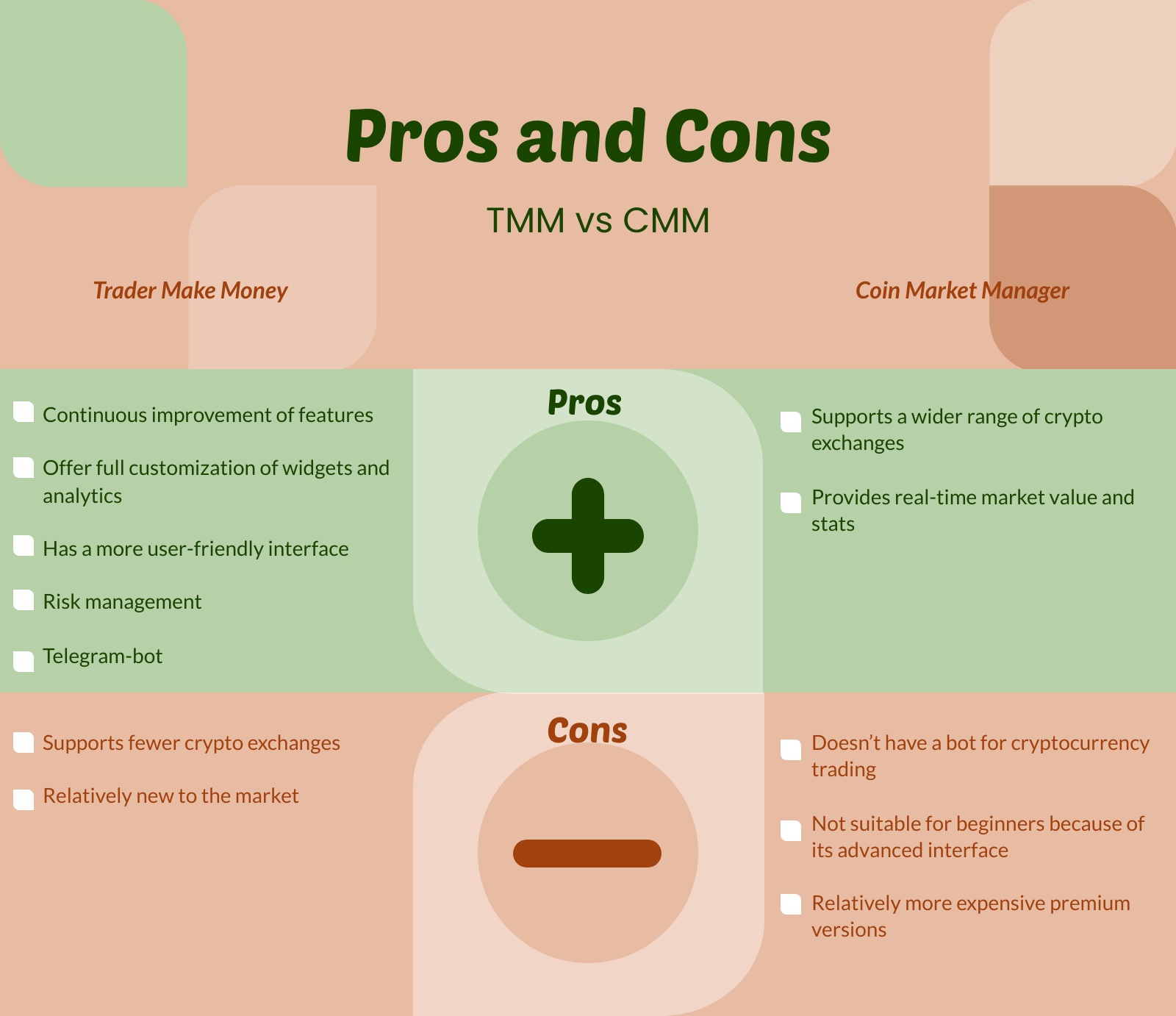

Pros and Cons: CMM vs. TMM

If you reached this part of the article, maybe you already have a clear idea of the best crypto trading journal for your trading needs. Otherwise, here’s a summary to help you pick: