Risk Management or How to Trade in the Red and Earn Money (now easy with the TMM)

You've probably heard the phrase that you can enter a trade simply by flipping a coin and still remain in the black with the right risk management. And it's true! 👇

Take a look at your losing trades! Are you losing the same on all of them, or does one trade consume 10% of your deposit? If you know what I mean, then risk management is something you need to implement as soon as possible in your trading! Consider this the trader's holy grail. Even the most successful strategy is doomed without risk management.

- What parameters should be taken into account?

- Risk per trade

- Deposit risk

- Leverage and x125 league

- Update: new Risk Management section ✔️

What parameters should be taken into account?

First, let's define your goals. 🎯 We must lose as few as possible in a trade and never exceed the set limit. Then you will forget what liquidation is, and see that trading will become much more pleasant. After all, you know in advance that if you get a stop loss, you will lose no more than N money. And this amount shouldn't make you shake over each trade wiping sweat from your forehead, but calmly let the market go towards your goals.

All trades should be subject to the same rules. There are no super trades or super setups. Your loss is always well-defined.

Risk per trade

Let's say your deposit is $100. We recommend for beginners to set no more than 2% risk per trade. So, you should not lose more than $2 in a trade in any case. This will give you more space to hone your skills and your strategy.

❗ But you cannot put a stop-loss just at the level of losing 2%. It should be placed where your setup is definitely refuted by the market. We do not control the entry price, nor do we control the stop loss. What is left for us? Only the volume of the order!

It is by reducing the volume of the order that you can place a long-range stop loss, if necessary. In the near future, we will try to add an online calculator that will tell you the allowable transaction volume.

Deposit risk

The risk on a deposit first of all saves you from “tilt” 🤦♂️.

Tilt is a condition when a trader, in an impulse to win back a loss, plunges more and more into unprofitable transactions until he receives a significant loss or the complete liquidation of the deposit.

To do this, you set a limit in advance. We recommend that you stay within 5% of your deposit lose per day. But it all depends on your strategy, and someone admits a loss of 20%. For beginners, it is better not to bet more than 10%.❕

After setting this limit, you can trade during the day either in plus or minus, complying with the risk per trade, and at some point a series of unsuccessful transactions leads you to a loss of 5% of the deposit. Here you have to learn to stop yourself. No matter how much you would like to continue, no matter how the desire to recoup makes you enter the market again and again, the most correct decision would be to turn off the terminal. Relax, collect your thoughts.

☕ Spend time analyzing trades, sipping coffee and taking a walk in the fresh air. Believe me, this rule was written at a cost of hundreds of millions of dollars. You do not lose your chances, the market will give you the opportunity to earn a thousand more times. But failure to comply with this rule will inevitably lead you to the loss of your deposit 🙅♂️.

Leverage and x125 league

Big leverage = a lot of money, right? NO! In 99% of cases, a big leverage is just greed and a desire to get here and now, all the money in the world. As soon as you borrow too much, you turn trading into a casino. Hit or miss. Either everything or liquidation. This approach always leads to losses. Even if you are lucky a couple of times, no strategy will survive the long distance with this approach.

☝ You can raise your leverages only when you start earning steadily. Little by little. But remember, even if you have 20 leverage, you cannot afford to lose more than 2% per trade. This means that your stop is very close to the entry. Ask yourself if you know how to enter the market so perfectly?

Therefore, 2-3 leverage is the maximum for a beginner. You will be able to feel what the leverages are and even !double! your earnings, just using the second shoulder, and at the same time, put a sufficiently long stop.

"But controlling your risks is difficult and dreary!"

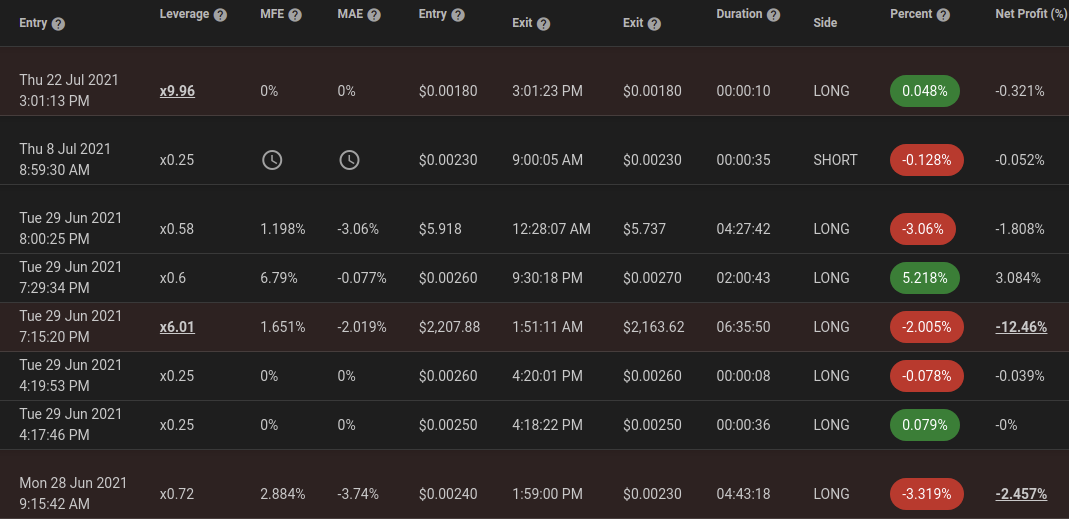

That's right, that's why we've added a new Risk Management section to tradermake.money, which you will find in the left menu. There you can set all these parameters and the diary will highlight your transactions in red, if you have not followed your RM. It will send you a notification in Telegram (if you have connected to our bot) and tell you when to stop trading and take a break!

The calculation is carried out in relation to the column Net profit (%), which calculates your profit relative to your deposit at the time of the opening of the trade.

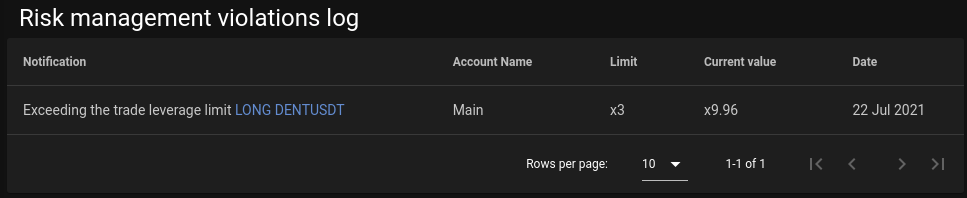

And also, there is a Log of violations, where you can see when and how much you have exceeded your RM. I hope your Log remains empty!

All you have to do is follow the recommendations and earn money, because trader makes money!

P.S. the "Risk management" section is available for the "Trader" and "Trader PRO" levels. More about tariffs.