Why Do Most Day Traders Fail?

Day trading is often portrayed as a quick path to wealth, yet the reality is starkly different. With over 90% of day traders failing within their first year and 85% bowing out by year three, the journey to profitability is fraught with obstacles. Grasping the nature of these challenges is a crucial initial step in surmounting them. This article delves into the common pitfalls that hinder day trader success and offers actionable advice for aspiring traders.

Common Mistakes Leading to Day Trader Failure

Mistake #1: Lack of Foundational Knowledge

Many day traders jump into the fray without understanding the market dynamics. Like any skill, trading requires a blend of theoretical knowledge and practical experience. Beginning with simulated trading can help newcomers acclimate to market conditions and trading platforms before risking real money.

Explore essential insights and strategies for success in cryptocurrency trading with our latest article: "Unveiling the Top Books for Aspiring Crypto Traders".

Mistake #2: Missing a Competitive Advantage

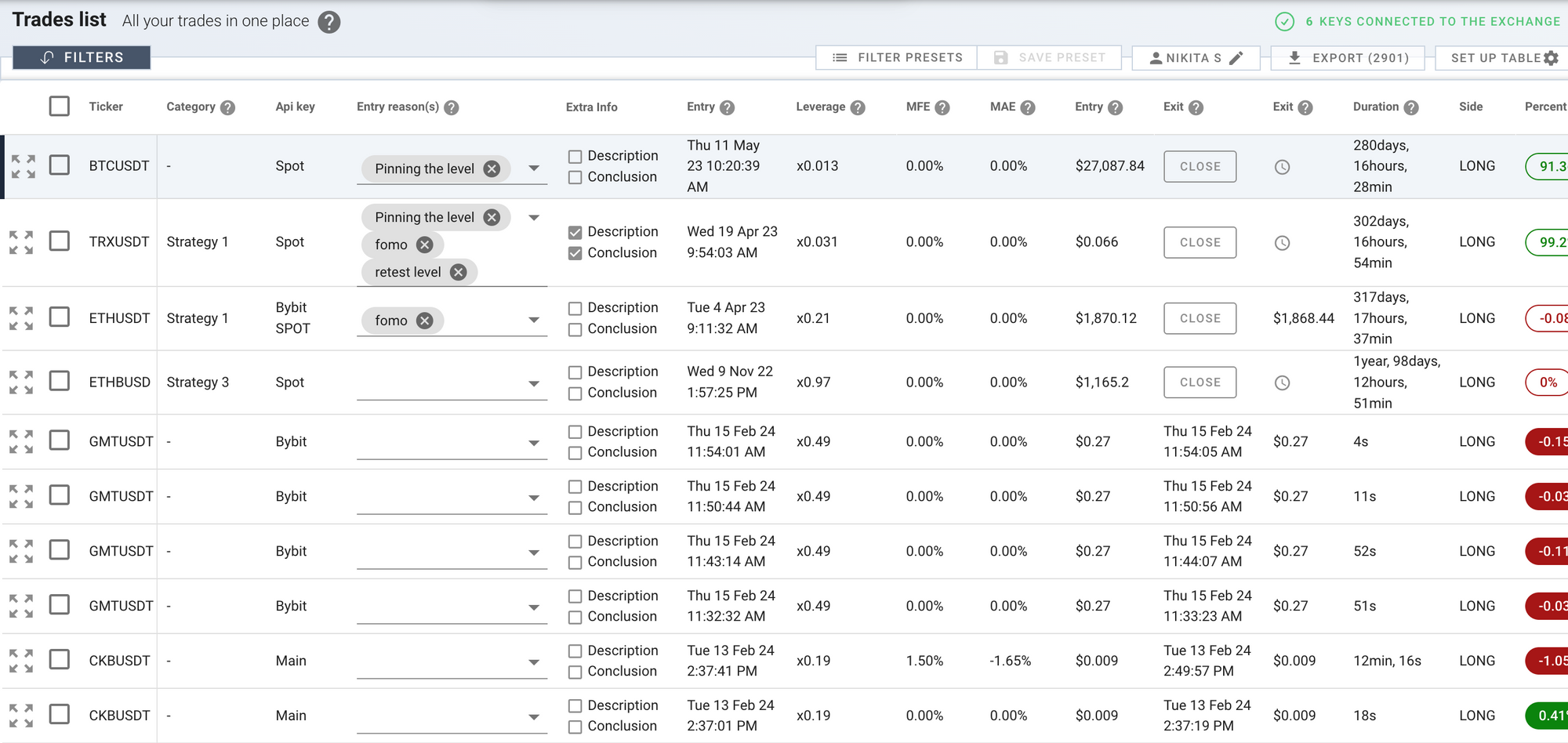

Success in trading demands a personal strategy that aligns with your temperament. Copying others without understanding the underlying principles of their strategy is a recipe for failure. Developing a unique approach tailored to your strengths and preferences is crucial. A trading journal is essential in this endeavor, facilitating the documentation and evaluation of your trades to discern the most successful strategies. By diligently logging each trade, detailing the strategy employed, its results, and pertinent notes, you can conduct a thorough analysis and backtesting to gauge the efficacy of your plan. Such analysis provides valuable feedback, allowing you to tweak and perfect your strategy to align more closely with your individual trading style and objectives. A trading journal thus becomes an indispensable tool in discovering and honing your competitive edge—the unique value you bring to the trading arena.

With this clarity, you can confidently define and refine:

- The success rate of your strategies is informed by thorough backtesting.

- Strategies that resonate with your personality and trading style.

- The specific strategy you plan to employ.

- Your overall approach to navigating the market dynamics.

Armed with this insight, you're equipped to develop a detailed trading strategy that capitalizes on your strengths and is in harmony with your trading goals, establishing a robust base for success in trading.

Mistake #3: Constantly Changing Strategies

Consistency is crucial to trading success. Abandoning a strategy at the first sign of failure instead of adapting to changing market conditions can derail potential success. It's important to analyze why a plan is ineffective and decide whether to refine or replace it.

Mistake #4: Absence of Patience and Discipline

The lack of discipline to stick to a trading plan and the impatience to wait for the right trading opportunities can be detrimental. Cultivating these qualities in one's personal life can positively impact trading performance.

Mistake #5: Setting Unrealistic Time Goals

Imposing short timelines to achieve profitability adds unnecessary pressure. Focusing on skill development and understanding market nuances over time can lead to more sustainable success.

Mistake #6: Failure to Record Their Trades

Approaching trading as a serious business venture is crucial for success, necessitating the measurement of performance indicators just as any business entrepreneur would.

To progress in your trading career, gaining insight into your performance metrics is essential. Identifying areas of difficulty is the first step toward improvement.

How can you achieve this? By meticulously documenting each trade you execute. Essential metrics to monitor include:

- Stop loss settings

- R multiple values

- Reasons for initiating a trade

- Reasons for closing a trade

- Your strategy before the market opens

- Actions you actually took

- Daily outcomes

Grasping the reasons behind financial losses, pinpointing profitable strategies, and recognizing missed opportunities are vital for refining your trading approach.

The most effective strategy for acquiring this knowledge is diligent tracking, journaling, and analyzing your trading activities. Discover more strategies in our comprehensive guide to crafting and utilizing a trading journal effectively.

Mistake #7: Poor Understanding of Personal Psychology

Individual differences play a significant role in trading success. Recognizing and addressing personal psychological barriers is crucial for advancing in trading.

For instance, specific traders struggle with adhering to their predetermined stop loss levels due to a fear of losing money. When their trades approach these stop loss points, they rationalize keeping their positions open, hoping the market will turn in their favor.

Conversely, other traders might be able to respect their stop loss limits but may find it challenging to exhibit patience, rushing trades instead of allowing them to develop naturally.

Identifying the specific psychological hurdles that affect your trading decisions is essential. Once these issues are identified, you can establish strategies to confront them directly.

Understanding your own psychological makeup is critical for trading success. A trading journal serves as an essential resource for documenting and examining your thoughts and feelings, assisting in recognizing and controlling psychological tendencies in trading.

Learn more about how psychology influences trading decisions and the common psychological traps traders fall into.

Mistake #8: Setting Unattainable Expectations

Setting expectations too high may result in unnecessary stress and letdowns. Acknowledging minor achievements and concentrating on gradual progress can lay a solid groundwork for eventual triumphs.

Mistake #9: Inability to Accept Losses

Accepting that losses are part of trading and learning from them is essential. Planning for potential losses and distinguishing between 'good' and 'bad' losses based on adherence to a predetermined plan can foster resilience.

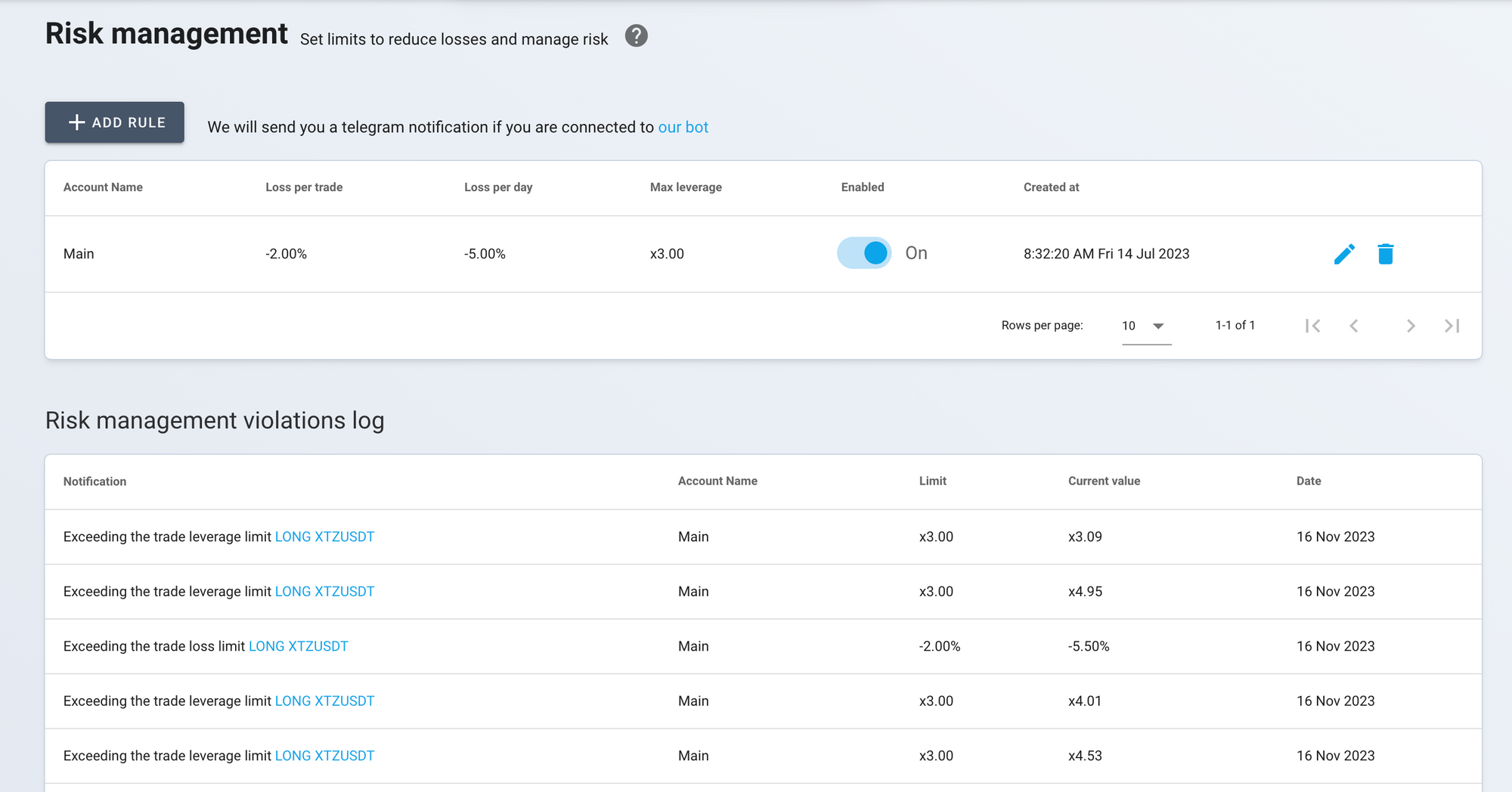

Mistake #10: Lack of a Risk Management Strategy

A primary challenge for many day traders is ineffective risk management strategies.

It's important to remember that market movements are inherently unpredictable. While you cannot determine the specific outcome of a trade or its direction, you can implement measures to control risk.

Consider the potential for adverse outcomes and prepare accordingly.

Losing money is an undesirable but inevitable aspect of trading. Becoming proficient at managing losses includes understanding and accepting the maximum amount you are willing to lose.

Before initiating a trade, establish your stop-loss criteria. At this point, you acknowledge your analysis was incorrect and decide to exit the trade to minimize losses, such as limiting a loss to $2,000 rather than risking $20,000.

By setting these parameters, you effectively manage your potential losses. Although you cannot predict daily market fluctuations, you can ensure you are prepared for the worst-case scenario.

For an in-depth exploration of risk management techniques in trading, refer to our comprehensive guide.

Towards Trading Success

Understanding and avoiding these common pitfalls can pave the way for a successful trading career. Tools like TraderMake.Money offers valuable resources for tracking trades, refining strategies, and mastering risk management. By focusing on skill development, personal discipline, and strategic planning, aspiring day traders can navigate the challenges of the market and work towards sustainable profitability.

Embarking on the trading journey with awareness and the right tools can transform the daunting task of day trading into a manageable and potentially rewarding endeavor. Register with TraderMake.Money to access comprehensive tools to support your journey to becoming a successful day trader.