Mastering the Marathon: Crafting Your Unique Crypto Trading Strategy

A lot of rookie crypto traders think there's some magic "hack" or "cheat code" to turn consistent profits. But the truth is, there's no secret sauce in this game.

Success in crypto trading isn't a guaranteed science. Sure, there are tried-and-true strategies that have worked for many, but there's no one-size-fits-all solution. Every trader is unique – their style, their risk tolerance, their level of crypto know-how. What works for one person might not work for you.

Instead of hunting for a silver bullet, the smart play is to develop a strategy that aligns with your individual style and characteristics. Learn, test, refine, repeat - until you find an approach that really clicks.

Crypto Trading Strategy

Developing your own killer crypto trading strategy isn’t a walk in the park – it's going to take time. But here's a game plan that might help:

- Level up your knowledge: Start with the basics of trading and the common strategies out there. Hit up books, online courses, webinars, blogs, and any other resources you can get your hands on.

- Become an analysis ace: Get your head around technical and fundamental analysis. Learn how to read charts and indicators, and understand the macro news and reports that move the market.

- Define your trading personality: What kind of trader are you? This could hinge on your risk tolerance, the time you can commit, your nerves of steel (or lack thereof). Some dig long-term hodling, others might vibe with day trading or scalping.

- Test drive strategies: Once you've got the basics down, start running different strategies on a demo account or simulator. This lets you see what works for you (and what doesn't) without putting actual money on the line.

- Analysis and tweaks: As you apply and test various strategies, review your results and refine as necessary. This might involve altering parameters, adding or dropping indicators, shifting time frames, and so on.

- Never stop learning: Crypto trading is a constant learning curve. The markets never stop evolving, and as a trader, you've got to keep up. Keep learning, keep applying fresh insights to your strategy – that's how you stay in the game.

Remember, there's no such thing as a "perfect" strategy that'll guarantee profits every time. Your goal is to build a system that yields steady profits over the long haul.

Why Analysing Your Trades Is Crucial to Your Strategy

Trade analysis is vital to forging a winning trading strategy. It’s at the heart of any trader's quest for improvement.

Analysis helps traders make sense of past trades, spot patterns, and learn from their hits and misses. For instance, if you're consistently losing money on a certain trade type or at specific times, analysis can highlight these patterns. Once you know what's not clicking, you can tweak your strategy for the better.

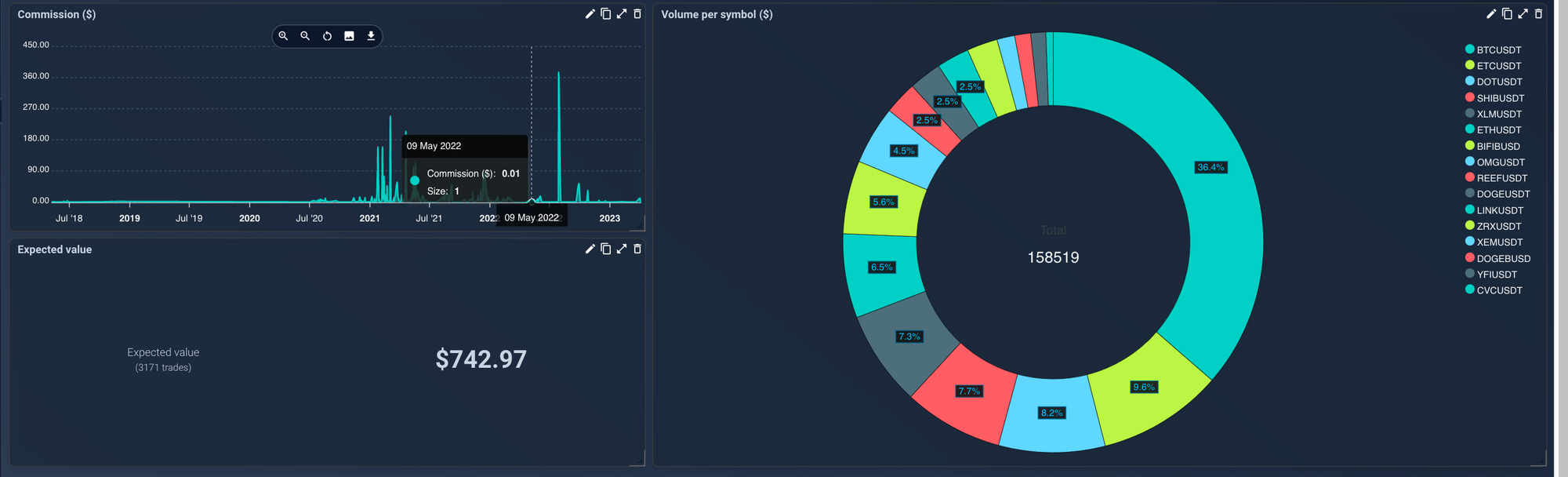

Keeping a trading journal makes this process a whole lot easier. Document all your trades, including entry and exit prices, position sizes, and trade times. Using widgets can give you a broader view of your trading performance, beyond just individual trades.

Trade analysis encourages critical thinking, adaptability, and constant learning – all essential for trading success. Without it, you might find yourself repeating the same blunders over and over without understanding why you're striking out.

Remember, trading isn't a sprint with everyone running the same course. It's more like a marathon where each runner picks their own route and pace, based on their unique abilities and circumstances.