Swing Trading vs. Scalping: What Is The Difference? (Plus Useful Tips)

With cryptocurrency’s infamous fluctuations, many types of trading techniques originating from traditional markets continue to thrive. For example, many crypto traders harvested millions by just betting on the tiniest price changes within minutes, which corresponds to the high volume of scalpers in the market. Then, there are also part-time traders who follow the obvious direction of the price, which corresponds to a high number of retail swing traders.

So, if you're a budding crypto trader who wants to learn more about swing trading basics or scalping tactics, this one's for you.

What is Scalping?

Traders that apply scalping tactics, often known as scalpers, earn a profit by purchasing at low prices and selling at high prices. However, they make money off of even the smallest disparity that exists in the asset price. Therefore, even the smallest fluctuations in crypto prices are treated as opportunities.

The downside to this, however, is the minimal profit from each trade. Therefore, several trades are made with very short holding periods (often just minutes) to accumulate a significant amount of profit. Scalpers act quickly and follow few, if any, consistent day trading indicators. Scalpers take short positions in one transaction and long positions in the next, looking for frequent, albeit tiny, chances. In principle, scalpers make money by taking advantage of the buy and sell price disparities. These windows of opportunity are more prevalent compared to massive price changes, as even relatively calm markets experience regular fluctuations.

The majority of scalpers employ charts with a time window of around a minute or so. Scalpers may benefit from charts that read even the slightest price “pips”. The quantity of transactions is used to show price movement within a 24-hour period, where a new bar (or candlestick, line section, etc.) is drawn after a certain threshold has been reached (ticks).

What is Swing Trading?

Swing trading definition: Reading the trend and making a profit from it. For instance, traders in this category typically invest in a highly surging crypto after it has corrected or consolidated, and then they cash out just before the price begins to climb again. Swing traders monitor the charts from time to time, and they open positions based on the prevailing price trends.

For example, when there’s a sudden downtrend that breaks the support level of the asset, swing traders will most likely start borrowing to short the asset. On the other hand, when technical indicators show an imminent upswing, these traders will ride it. Most swing traders follow the direction of the market trend. They become day traders during an uptrend and a short trader when the downtrend starts. When someone is betting on market trends, they often enter a position and hold it for a few days or weeks (even months), depending on the opportunity that the trend provides. Like scalpers, swing traders benefit from some degree of market volatility since it creates opportunities for them. Swing traders are able to retain a high degree of profit potential while reducing their brokerage fees to a minimum.

Traders with minimal time to monitor the markets on a regular basis can implement swing trading strategies. Real-time or prompt decision-making is not necessary in swing trading. This method is popular among part-time traders who use their lunch breaks to check the markets. An effective trading strategy requires patience, holding the asset overnight (or longer) and reviewing the market both before and after trading hours. That's why it's not a good choice for people who become nervous in high-pressure circumstances.

Best Swing Trading Indicators

Trend riders employ simple charting techniques to identify favorable buy or sell signals. Here are some technical indicators that many swing traders use to aid their decisions:

I. Fibonacci Retracements

One of the best indicators for swing trading is Fibonacci Retracements. Traders use the Fibonacci Retracements to spot potential triggers of breakouts in either direction. Normally, traders monitor reversals when the price consolidates after the support or resistance point has been broken.

II. Moving Averages

Traders use this indicator to spot potential reversals or an increase in momentum. For example, when a shorter MA overlaps with the longer MA, a shift in direction could be coming. Conversely, when the long-term MA overlaps below the shorter MA, an uptrend could happen. Moving average indicators are particularly useful when traders spot a “golden cross” on the chart, signaling a bullish upswing.

III. Relative Strength Index

Using this swing trading indicator, traders are able to predict an imminent price drop when the RSI rises around the 70 mark. When it reaches below the 30 mark, it indicates overbuying and a potential upswing.

IV. Bollinger Bands

It’s a swing trade indicator that aids in setting the entry point when the price of crypto falls below the lower band. They may wait for the price to close back above the band before entering the trade. This is a form of confirmation when applying mean reversion strategies. A reversion to the mean is complete when the asset rises back to its moving average. Some investors use this as an exit point.

Which One Best Fits Your Style?

Swing trading's main advantage over scalping is its lower volume of trading. It often entails fewer orders and hence lower tradingexpenses. It is not always necessary for a trader to keep a close eye on their positions when engaging in swing trading because positions might be formed over a period of days or weeks.

Swing trading involves fewer transactions but typically results in a higher net profit. Consequently, swing traders may sometimes make as much money as scalpers while engaging in far less risky and time-consuming activities, realizing significantly larger profits from each transaction.

Scalping involves purchasing an asset and then selling it back to the market on the same trading day. While closing all trades for the day may provide some traders with a sense of security, this strategy may also appeal to those looking for a more interesting trading experience.

Scalpers are shielded from big losses attributed to a single transaction because the profit margin on each deal is considerably lower when scalping. Scalping, which involves making small trades in multiple successions within short-term periods, is less prone to catastrophic losses than swing trading.

You need to give some consideration to a few specific perspectives before settling on the kind of trading strategy that you will put into action. Scalping involves a very quick pace, so you need to determine how much stress you can handle before you start. Scalping is a more strenuous form of trading since it requires strong focus for prolonged periods of time. This is because the windows of opportunity for scalping are much smaller. In comparison, swing trading allows traders to wait for many days before taking any action, but it gives traders greater freedom. Before swing traders may open a position, there has to be a clear indication that a trend is beginning to emerge.

Knowing your tolerance to stress, preferred pacing, spare time, and flexibility will lessen your risks in implementing these strategies.

Consider This Before Scalping or Swing Trading

There’s no foolproof strategy for swing trading or scalping. A great deal of dedication, effort, and education are always required. However, it’s not only about knowing the meaning of concepts that will help you succeed. Practical experience is the most important part. Finding a trading technique that consistently yields positive outcomes is the key to being a successful trader.

PRO TIP: You have the option to participate in something called "paper trading," which entails simulating the execution of actual transactions through the use of a trial/demo account. You may evaluate the platform, put your trading methods into action and hone your trading abilities by using a demo account, which is provided by many exchanges free of charge.

So, “how much can you make day trading?” The success of your strategy depends on a wide variety of market conditions, which requires extensive practice. You can make $100 a day trading cryptocurrency or hundreds of thousands in a single swing trade, but it entails patience and devotion. Therefore, before risking serious cash, you should make hundreds of trades on a demo account first.

Using an Automated Trading Journal for Scalping or Swing Trading

For hardcore traders, it’s always important to make decisions based on established data and objective analysis. This is where an automated trading journal comes in handy.

Trader Make Money is one of the best automated trading journals for scalpers and swing traders. It’s an intuitive trading journal that allows traders to personalize their analytics dashboard using incredibly useful widgets.

FOR SCALPERS

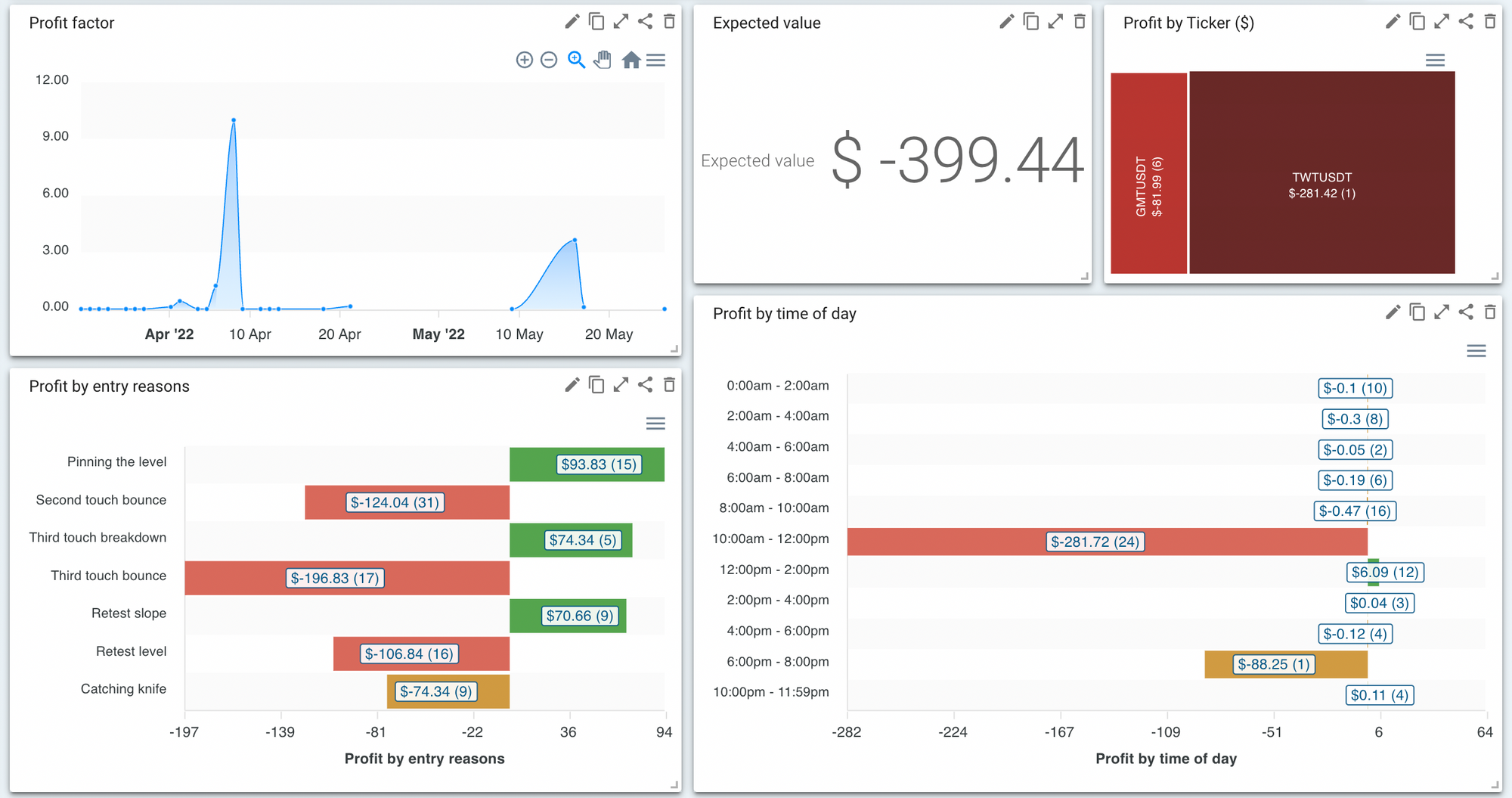

- Profit Factor

The Profit Factor is an important widget for scalpers because of the volume of transactions coursing through their accounts. Analyzing all these traders is impossible using a spreadsheet. However, an automated trading journal can easily record all transactions, analyze them, and provide easy-to-understand results.

Now, using the Profit Factor widget, a scalper can determine the success rate of his trading strategy. The profitability ratio can be calculated by evaluating the total profit from the trades divided by the total losses. A value above 1.6 (for more confidence) is a good indication.

- Expected Value

This widget shows the value of your potential profit per 100 trades. If it is negative, it means that the trading strategy you’re currently using needs to be changed. However, you cannot take this number as a guarantee of future profit. The expected value works more like a “profit factor” and is considered a plus/minus value.

When scalpers trade within the day, emotional factors could affect their performance. Sometimes, they could be using the wrong style or following a faulty indicator. With this widget, patterns can be spotted and scalpers are able to decide if it’s time to stop or continue.

- Profit by Time of Day

Some scalpers trade in several sessions, and these periods can coincide with different time zones, such as Asia, Europe, and America. However, it’s important to know that market behavior changes depending on the time of the day. Using the Profit by Time of Day widget, scalpers can find their ideal work hours. Scalpers who want to take advantage of their most profitable hours can further analyze their performance through Profit Distribution by Time of Day.

- Profit by Ticker ($)

Often, many traders are tied to their “favorite” coin and trade it all of the time. With this widget, traders can identify the most profitable coins in their portfolio, including the ones that incurred the most losses.

Basically, it is a profit and loss heatmap. The map shows where the trader loses the most money, which calls for a change in strategy. It’s important to note that this widget becomes more accurate if it analyzes more transactions. Therefore, traders need to draw a conclusion after having at least a couple of weeks (or months) of trading.

But, the most important advantage for scalpers of this trading journal is the ability to group widgets by minute or hour.

FOR SWING TRADERS

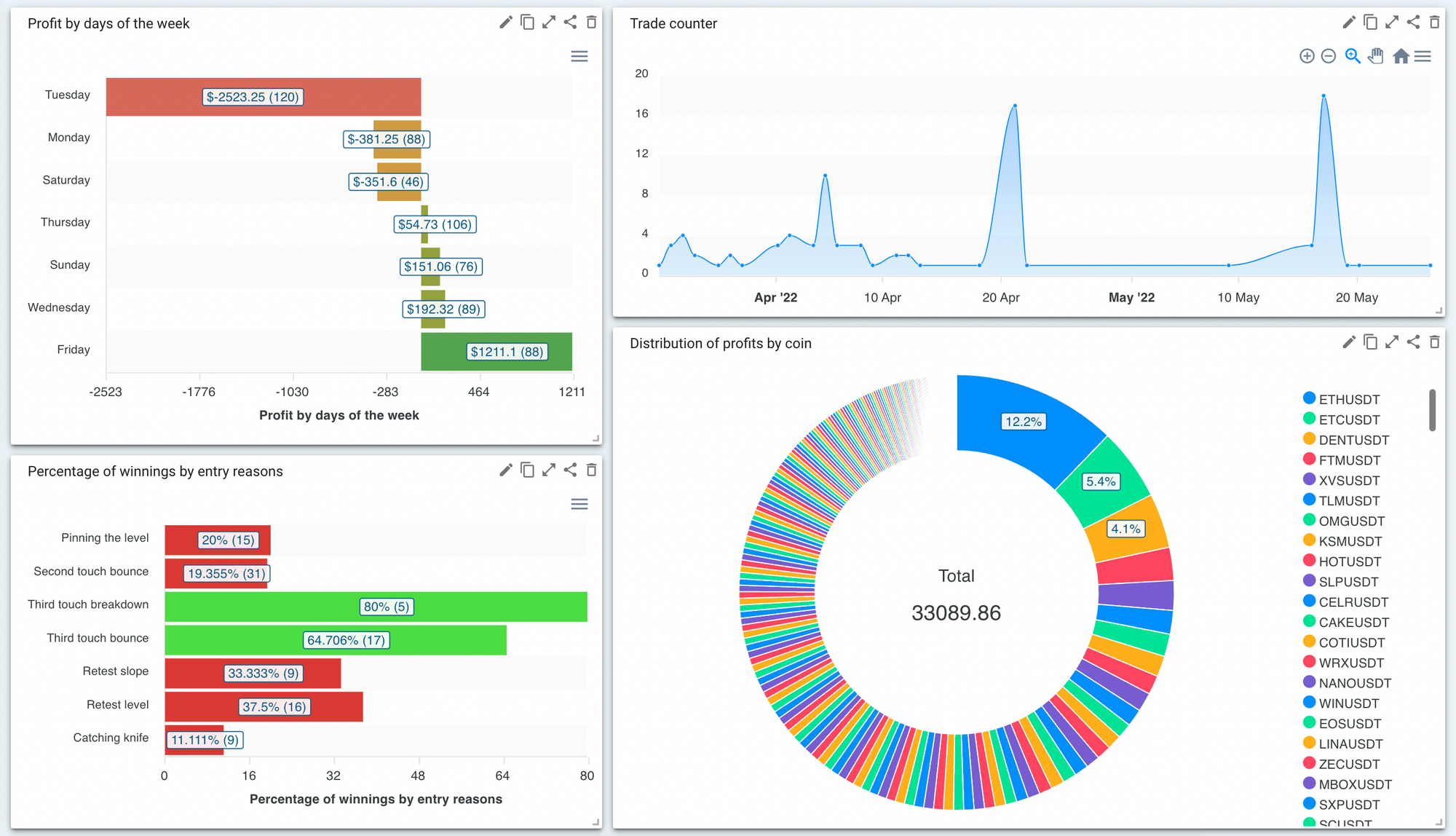

- Profit by Entry Reasons

A very important widget that allows you to identify successful strategies and exclude losing entry reasons. For this widget to work, you must fill in the “reasons for entering” in the My Trades section. This widget allows traders to look past the numbers and analyze the logic supporting each of their strategies.

- Average MAE (%)

Maximum Adverse Excursion (MAE) measures how far the price went against you for the period of the trade. It reflects how much the price went in the opposite direction from your entry point. So, it shows how inclined you are to “sit out” stop losses. The average value is suitable for selecting the most optimal stop-loss limit.

Average MAE (%) can be used in conjunction with Average MFE (%) and Reason for Entry to possibly optimize take-profit targets and stop-loss limits.

- Average MFE (%)

Maximum Favorable Excursion (MFE) measures the largest observed profit during a trade. The MFE is the value of the peak profit for the trades. If your TP level is much higher or much lower than this value, you may not be placing it at an optimal level. Swing traders who don’t know where to place their TP levels can benefit from this widget.

Trader Make Money is an automated trading journal that offers a variety of widgets that can aid all types of traders. So, whether you’re a scalper, swing trader, arbitrage trader, market timer, fundamental trader, momentum trader, or day trader, keeping this type of trading diary will surely increase your profits and minimize your losses.