How Trader Journal Helps You to Improve Your Trading. Part 1

In this article, I will try to tell you why every trader needs a trader journal, how to use it, and how keeping a journal will briefly increase your earnings in the crypto market.

- Why keep a journal?

- What is a trader journal in reality?

- How to get out of the circle of random luck and frequent losses?

- How to improve future trades?

- Risk control

- Psychology in trading

- Holy Grail 🏆

Why keep a journal?

"The difference between victory and defeat usually hangs on a thin thread, and whoever is willing to give the game everything it requires and a little more has the potential for greatness."

Victor Niederhoffer

What separates an experienced trader from a beginner? Knowing secrets and some awesome strategy? Alas, no. Every day, beginners are trained by more experienced and successful traders, who reveal all their "secrets" to them. Do they immediately become rich? The answer, I think you know.

Why don't just other people's knowledge and strategies not work and make you a guru instantly? Because you will not be able to apply this strategy the way the author uses it. There will be a lack of self-control, discipline and risk control 😔.

How can a journal help you? Journal is disciplined and if you think trading is an art then I'm afraid I have bad news. I would compare trading to war, and traders to soldiers. And in this war, your every mistake or indulgence can "kill" your deposit with one control shot.

How often did you earn a little, increasing your deposit, so that at one moment, in one order, all your work could be drained down the toilet? Sound familiar? I also know millions of other traders who did not understand the simple rules of the game, left the market and now tell us that this is a "casino".

What is a trader journal in reality?

It is you! Your portrait in figures and graphs. See this trade where you decided to move the stop? Or a trade where you decided that this is definitely the best setup of the day, and you absolutely need to go to 10/20/75 leverage?

🙅♂️ And without a journal, you can forget this trade, erase it from your memory. And continue trading without changing anything. And so every day. Today you woke up and sat down at the terminal. They rejected the session and left with peace of mind. Groundhog day with no chance of progress. Once you get up with a big smile, the day is closed with a plus. And it doesn't matter that there was a week of failures before. You will remember this day, and it will give you the strength to go through another week of stop losses and losses, until one day your deposit capitalizes and a white flag appears on the balance line.

How to get out of the circle of random luck and frequent losses?

"If most traders could learn to sit back 50% of the time they trade, they would make a lot more."

Bill Lipschutz

📌 Introduce rules into your trading. Every trade must have a reason to enter. Better yet, three! Before clicking on the "BUY" button, please answer the question, "why am I entering this trade?" And write it down. When you close the trade and see your result, immediately look at your reasons with a different look and draw a conclusion, write it down.

"But it’s boring, it’s a long time, I’ll be late, the price is about to fly away..." 🤨

In 90% of cases, after entering a trade, the price will return to your entry point more than once. Don't be afraid to miss a moment. Be afraid of trades that you shouldn't have entered at all, where the price didn't even go in your direction.

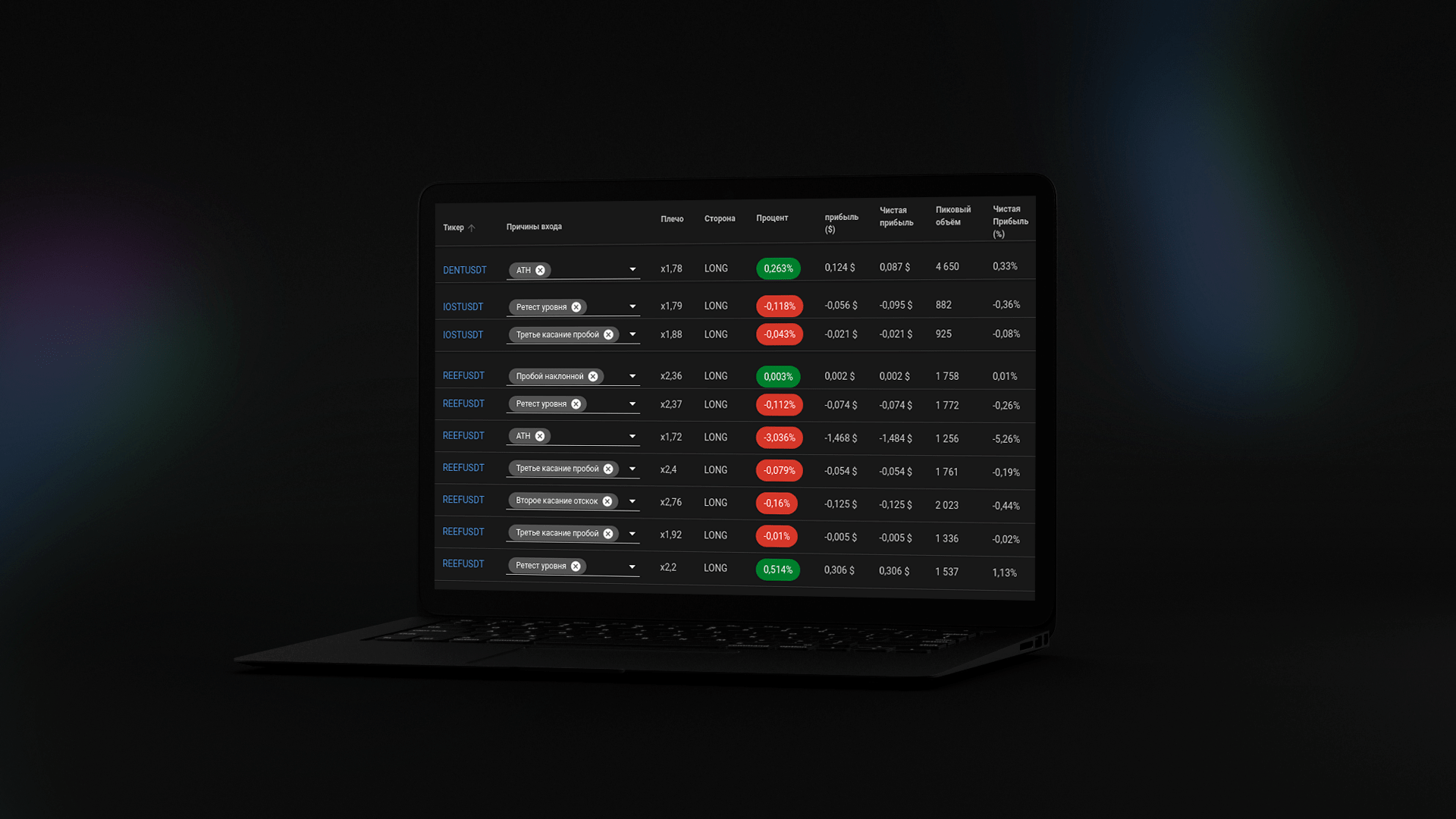

And, of course, writing orders manually in Excel or on a piece of paper is a monkey labor that a computer can and should do. For this, our journal was created ❗️

So, you've started to think about a trade before entering it. This should save you from 20-50% of "boredom" trades, in which there was no point other than the desire to trade.

How to improve future trades?

If you've just started keeping a journal, say just yesterday, start your day by looking at yesterday's trades. See your worst result. Analyze what you did wrong and why your entry reason didn't work. But take a look at your success as well, find trades you are proud of, add them to your favorites. Take note of your strengths and weaknesses. And start your trading day with this knowledge.

Such a ceremony should be carried out regularly. ✔️ Make it a rule to analyze every previous day. Look for your persistent mistakes and slap yourself in the arms next time. Look for reasons to enter that are constantly profitable for you and try to pay more attention to them.

The journal will tell you where to look, you just need to spend a little time analyzing. Believe me, the time you spend on analysis will bring you many times more than the time spent on mindless trades with a 50/50 chance of success.

Risk control

"It doesn't matter if you are right or wrong. What matters most is how much money you make when you’re right and how much you lose when you’re wrong."

George Soros

You do the analysis and avoid unnecessary trades. These are the steps that even 80% of traders do not take. But this, alas, is not enough. Remember, I said we were at war. And there are always casualties in war. They are inevitable. Nobody can always win. Losing trades shouldn't make you depressed. They must be calculated in advance and precisely defined.

🙁 "But I put my stop loss anyway!"

Isn't it? But this is not enough. It is important that you always risk a fixed amount of the deposit. For example, you are ready to lose no more than 2% of the deposit in one order. Your deposit is $100, which means you are ready to lose no more than $2.

We will not go into details of risk management in this article, but you must remember that there are no "super" trades for which your risk management is not applicable. There are no setups in which you can not place a stop loss.

Read more: Risk Management or How to Trade in the Red and Earn Money (now easy with the TMM)

One time is enough to completely crush your deposit and lose the war!

Psychology in trading

"Success in trading comes from a good knowledge of the markets and an even better knowledge of ourselves."

Larry Williams

It would seem, what does psychology have to do with it? Dry numbers, strategy, profit and nothing else. But no, it is psychology that will truly take you to the next level.

Gradually, you will learn to analyze your actions and control your greed.

And the time will come to start building your strategy.

Holy Grail 🏆

After analyzing your trading, you will probably be able to answer the question, which trader are you? Lightning-fast making a decision to enter or exit, or vice versa, thoughtful and taking a long time to decide to enter the market.

Each type of trader has its own strengths and demons to fight against.

For example, you are good at finding an entry point, but immediately exit, having received a minimum profit of 0.5%.

Sitting there and letting your bottom line grow is an unbearable torture. This is your point of growth. Determine in advance, before entering a trade, the points where you want to close the trade. Place limit orders and do not touch the trade after entry. Does not work? Close the tab. You have precisely determined your stop loss and the loss will not exceed 2%. That's it, your work is over. Switch to another tool, make a cup of tea, whatever.

Hope you get what I mean. Your psychology is your key to a strategy that will work 100% of the time. And no one can repeat it or perform it better than you.

🔥 This war is won not by the talented, but by the stubborn. And you can make $1,000 / 10,000 / 100,000 if you start to take your trading seriously.

Start small today. Give yourself 5 minutes before each trade to think about it. Treat each trade as if it depends on whether you win this war or lose forever.

In the next article I will tell you how to keep a journal as efficiently as possible, subscribe! 👉