Trend Trading vs. Counter-Trend Trading: What Should Crypto Traders Choose?

Hey traders!

Let’s talk about a topic that always sparks debate: riding the trend or catching reversals? The choice between trend and counter-trend trading is more relevant than ever, especially now when bots and AI are moving the market faster than you can click “Buy.” To figure out what works best for you, you need proper analysis. That’s where a trading journal, like TMM, comes into play — it helps break down your trades and see what’s really paying off.

1. Trend vs. Counter-Trend Trading: Key Insights with Real Examples

Trend Trading: Ride the Wave

Trend trading is all about one thing: the trend is your friend. In crypto, this hits different — trends often get supercharged by whales and trading bots.

Pro tip:

When big players start pushing an asset, bots pick up the momentum, accelerating the move. This means a solid trend can turn explosive in no time.

🔥 Real Example:

Take the rally of Solana (SOL) after the Solana Pay x Shopify integration. Once SOL broke the $100 resistance, trading bots piled in, pumping the price to $120. Traders who entered after the retest of $100 bagged a clean 15-20% gain.

- Watch the volume: If price breaks out but volume doesn’t follow, that’s a red flag.

- Wait for confirmation: Indicators like EMA and MACD help spot real trends versus fakeouts.

Counter-Trend Trading: Play Against the Crowd

Counter-trend trading is for those who like to snipe quick profits by catching reversals. The idea? Jump in when the market looks stretched and ready to snap back. But don’t get it twisted — this approach isn’t for the faint-hearted.

Common mistake:

Assuming every pump leads to a dump. Bots often create fake pullbacks to liquidate weak hands.

⚡ Real Example:

Bitcoin (BTC) tested $52k after fake news about new regulations. Many traders went short, expecting a pullback. But bots on top exchanges held BTC above $51k, wiping out stop-losses. A few hours later, BTC smashed $53k. The winners? Those who waited for proper reversal signals, like an RSI divergence on the 1H chart.

Look for divergence between price and volume. If the price keeps climbing but volume drops — a reversal might be brewing. But remember, bots love to fake volume too.

2. How Bots and AI Are Changing the Game

Let’s be real: trading in 2024 isn’t just about outsmarting other traders — you’re up against AI-driven bots that:

- Execute high-frequency trades (HFT) within milliseconds.

- Create fake breakouts and dips to trap retail traders.

- Automatically trigger buy/sell orders at key levels.

How does this affect your strategy? Check the table below:

| Factor | Trend Trading | Counter-Trend Trading |

|---|---|---|

| How bots affect it | Bots amplify trends by eating liquidity at breakouts. Example: ETH broke $3k, bots pushed it to $3.2k. | Bots trigger fake reversals. Example: ADA dips from $0.80, only to bounce back after stop-loss hunts. |

| Speed of execution | You have time to wait for trend confirmation. | Requires rapid decisions — bots correct prices fast. |

| Fake signal risks | Low if supported by volume and multiple confirmations. | High — bots manipulate short-term price moves. |

| Best market scenario | Strong, sustained trends. Example: BTC’s steady climb past $50k. | News-driven volatility causing short-term pullbacks. Example: SOL’s sharp retracement on headline drops. |

3. Pros and Cons: Which Strategy Fits Your Style?

| Aspect | Trend Trading | Counter-Trend Trading |

|---|---|---|

| Pros | - Easier to follow once the trend is confirmed. - Less stress, ideal for swing trades. Example: Holding BTC after it broke $50k. | - Higher ROI when timing reversals correctly. - Perfect for scalpers and intraday traders. Example: Quick longs on SOL after a $10 drop. |

| Cons | - Risk of entering too late, near the peak. - Profit builds up slowly. | - High risk of fakeouts. - Demands full attention and quick reflexes. |

| Best for | Traders who prefer calm, medium-term trades with steady growth. | Aggressive traders who thrive on volatility and fast trades. |

| Go-to indicators | EMA, MACD, trendlines. | RSI, Fibonacci levels, volume analysis. |

4. How to Use a Trading Journal to Master Your Strategy

If you’re already journaling your trades, here’s how to use it specifically for mastering trend vs. counter-trend strategies:

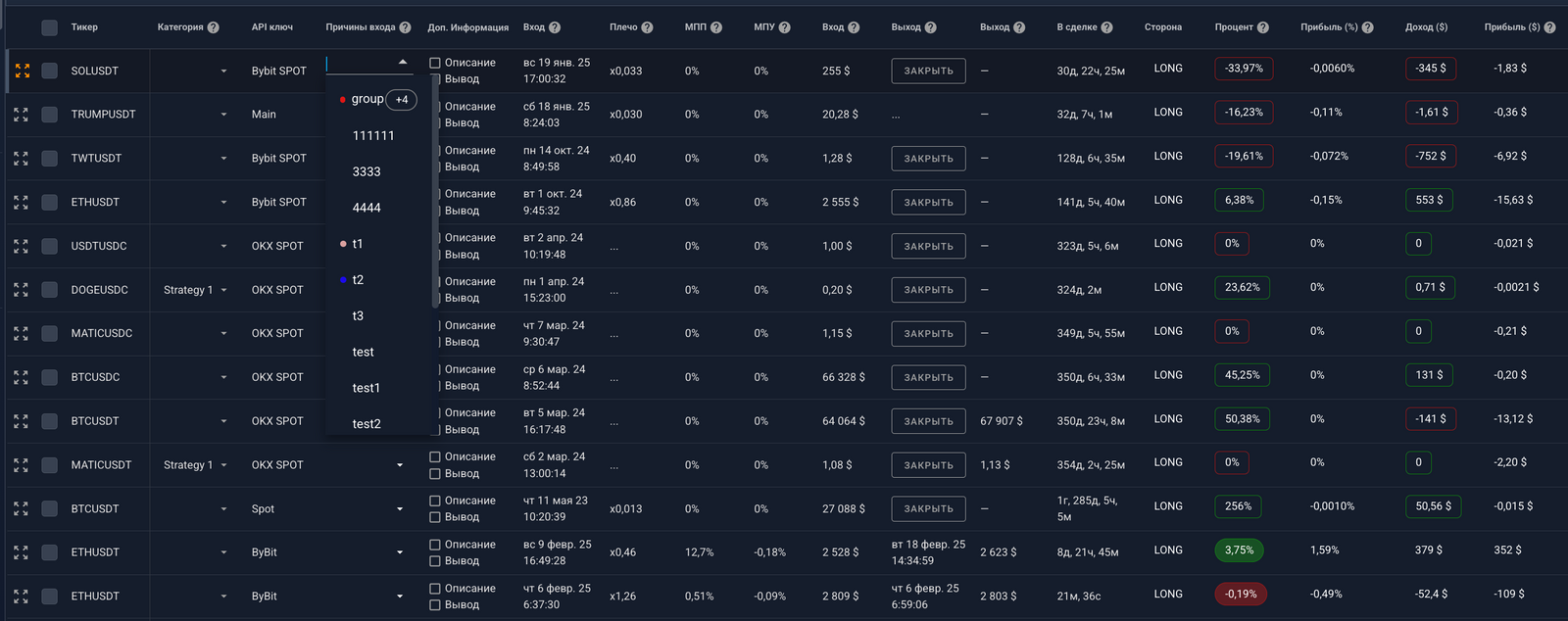

- Tag Your Trades by Strategy:

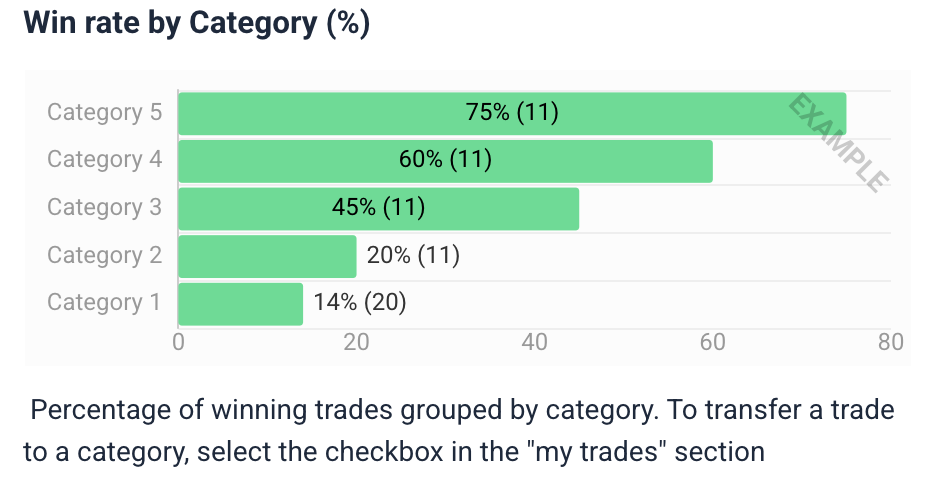

Assign tags like trend or counter-trend to each trade. This gives you a clear view of which approach yields better win rates. Journals like TMM offer a "Win Rate by Category" widget, making this comparison straightforward.

2. Analyze Strategy-Specific Performance:

Check which trades consistently hit profit targets. For example, you might discover that trend trades yield steady, smaller gains, while counter-trend trades either boom or bust.

3. Compare Indicator Effectiveness:

Track which indicators led to successful trades. Maybe EMA signals rock your trend trades, but RSI fails you in counter-trend attempts — or vice versa.

4. Context is Key:

Note the market environment for each trade — was it a news-driven pump? Bot manipulation? Over time, patterns will emerge, showing which strategy fits different scenarios.

4. Review and Refine Regularly:

Market dynamics change. Weekly or monthly reviews of your categorized trades will show if you need to adjust your approach based on current market behavior.

5. Key Takeaways for Strategy Selection:

- Split trades by strategy in your journal and compare performance.

- Identify which indicators give accurate signals for each strategy.

- Analyze how news and bot activity impact your trades.

- Adjust strategies as the market evolves.

- Always let data — not emotions — drive your decisions.

6. Final Thoughts & Next Steps

In today’s AI-driven crypto markets, you can’t rely on gut feelings alone. Whether you choose to ride the trend or catch reversals, the best strategy is the one backed by your own trading data.

Use your trading journal to track, analyze, and refine your approach. Let hard data guide you toward consistent profits. Trade smart, stay sharp, and keep adapting. 🚀