Turn Trading Losses into Lessons: A 5-Step Approach to Learning from Setbacks

🗣 Experienced a Trading Loss? Here are 5 Steps to Transform Your Loss into the Best Trading Lesson!

Trading, whether it's scalping or day trading, unavoidably entails setbacks and losses. However, our perception and response to these losses significantly influence our progression and proficiency as traders.

🏆 Roadmap to Convert Losses into Wins:

Step 1: Accepting Failure as Inescapable

Acknowledging that failure is a universal part of trading is vital. No trader wins perpetually. Even the most skilled and experienced traders face losses. This isn't indicative of incompetence but an inherent part of the trading journey.

Step 2: Gleaning Insights from Losses

Don't let losses dent your confidence. Instead, perceive them as an invaluable resource for learning. Assess your losing trades, decipher what went wrong, and devise ways to enhance your future performance.

Step 3: Emotional Control

Scalping and day trading are trading methods heavily influenced by emotions. However, it's essential to master your feelings rather than being controlled by them. Each loss can be nerve-racking and disappointing, but maintaining a level-headed and rational attitude is crucial.

Step 4: Risk Management

Implementing sound risk management strategies is key to limiting the adverse impacts of losses. Ensure your stakes are proportionate to your capital and remember each trade only represents a fraction of your overarching strategy.

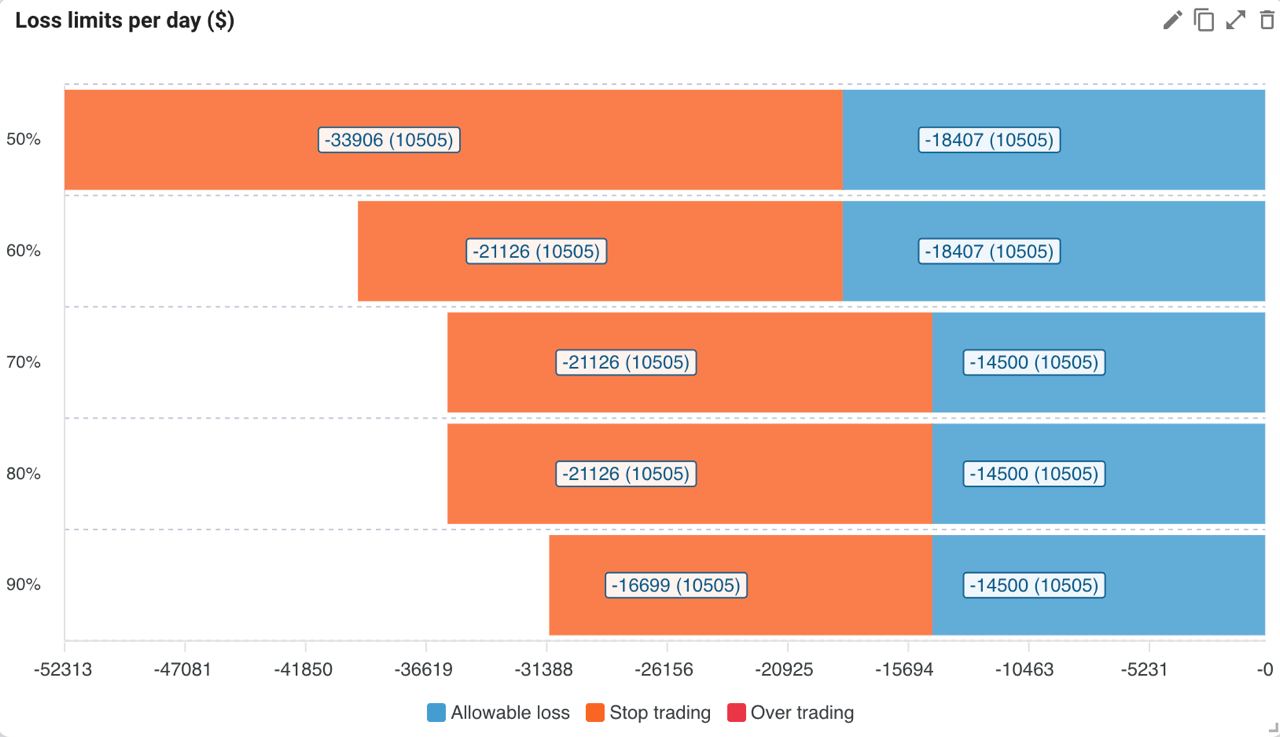

🔗 Our new "Loss limits per day" widget will display what level of loss is considered operational, helping to alleviate unwarranted stress.

🤔 - After what loss in a day does your chance to bounce back plummet?

🤔 - And what loss is considered your working loss and not worth worrying about?🤔 - How much do you give back to the market on average?

The new Loss Limits per Day ($) widget will answer all of these questions.

How to read this widget:

This widget counts your loss limits after which you should stop trading or start watching the trade especially closely. The widget calculates 3 indicators:

1. Stop trading - when you reach this loss for the day, you should stop trading. Percentages given on the left, for example 70% means that in 70% of days you have closed the day at a loss, when you reached the figures on the right.

2. Allowable drawdown - this figure shows your standard drawdown, after which you with the probability specified on the left have a chance to repay losses and come out in the black.

3. Over-trade - this indicator shows how much profit you give from your maximum daily rate.

Values of loss for the day, which are between the second index and the first - are a gray zone, in which continuation of trading is possible, but with special attention to each transaction.

What percentage to choose? Everything depends on your risk level: the lower the percentage on the left, the higher the drawdown is, but the less chance that you will get out of it. That's why it's recommended to aim at 60-70% for high-risk traders and 80-90% for conservative traders.

The more days, the more accurate the indicator, preferably not less than 6 months.

Step 5: Balanced Approach Towards Goals

Every trader aspires to succeed. However, an obsession with achieving goals can lead to burnout and rash decisions. Knowing when to pause and recuperate is critical.

Step 6: Seeking Promising Coins for Trading

🔝 TMM Cryptocurrency Top: Your Essential Guide to Choosing the Most Profitable Coins for Trading. Our Top is updated every minute, reflecting the real-time TMM trades.

With hundreds of tradable assets in the crypto world, it can be challenging to quickly pinpoint the optimal coin amidst a sea of opportunities. That's why we've created our Top - to help you effortlessly track the most volatile coins without trudging through extensive exchange lists.

Indeed, it's the volatile coins, displaying high transaction volume activity, that allow for the testing of new strategies and hypotheses, as well as profiting from price fluctuations. Remember, volatility equals potential earnings!

❓How to Stay Abreast of the Hottest and Most Profitable Coins to Trade:

1️⃣ Utilize our ranking directly on our site: tradermake.money/top-coins/

2️⃣ Add our @TraderMakeMoneyBot on Telegram and use the /hot command.

3️⃣ Use the handy mini-widget in your browser, easy to bookmark and granting quick access to the Top cryptocurrencies!

Now, staying informed about the market is as easy as opening a bookmark in your browser and gaining instant access to the hottest coins. It's simple and convenient! Integrating Top coins into your trading strategy can simplify your process and save time spent hunting for volatile coins.💰

Experiencing losses is never pleasant, but it's important to realize that a loss does not equate to failure. Your perspective on losses, ability to learn from mistakes, and capacity to manage emotions and risks will shape your long-term success in scalping and day trading.

❗️Remember, trading is more akin to a marathon than a sprint. Patience and persistence are key.