Mastering the Cryptocurrency Market: Avoiding Common Pitfalls and the Importance of Transaction Analysis for Successful Trading

Navigating the intricacies of cryptocurrency trading can yield rewarding outcomes, but it can equally expose one to potential risks and considerable losses. This is particularly common among novice traders, who often encounter pitfalls that deplete their deposits. In this discussion, we will shed light on some frequent blunders committed by crypto traders and highlight the significance of transaction analysis for successful trading.

Inadequate Market and Cryptocurrency Knowledge

The fundamental mistake frequently made by beginners is a deficient understanding of the cryptocurrency market and the workings of particular coins. Prior to embarking on trading, a solid grasp of blockchain basics is essential, as well as comprehension of the operating principles and technologies of the cryptocurrencies you aim to trade.

Let's hypothesize that you're initiating your cryptocurrency trading journey with a popular choice - Ethereum (ETH). Yet, you haven't invested adequate time in familiarizing yourself with Ethereum's fundamental operations, its technology, and market characteristics. This lack of knowledge can result in impulsive buying or selling decisions based on hearsay, news, or overarching market trends, instead of understanding the long-term potential and actual worth of the cryptocurrency.

A news story reporting an adverse event relating to Ethereum might trigger a rush of panic selling, resulting in a drop in price. Acting out of fear rather than conducting an objective analysis might cause you to sell your coins at a depreciated price. However, a solid understanding of Ethereum's fundamentals would provide insight that this is a transitory event and the coin's value can rebound over time.

Hence, an insufficient comprehension of the market and cryptocurrencies can lead to misguided decisions, financial loss, and diminished efficiency as a crypto trader.

Absence of Trading Strategy and Plan

The lack of a well-defined plan and trading strategy is another significant issue that can result in deposit depletion. Defining your goals, entry and exit points for transactions, and risk management measures are imperative. Without these, trading can turn out to be unpredictable and haphazard.

Suppose you're considering short-term trading with Binance Coin (BNB). But without a trading strategy and plan in place, and relying on intuition or sporadic internet advice, the results can be disastrous.

During one trading day, the BNB price begins to climb rapidly. You decide to make a spontaneous purchase, banking on the price surge continuing, hoping to profit from a brief price variation. However, after your purchase, the price goes into a sharp correction and decreases. If you had a solid strategy, optimal entry and exit points could have been identified, as well as setting stop losses to minimize risks.

Without a strategy and a plan, your trading can turn erratic and unpredictable, significantly raising the risk of depleting your deposit. For successful day trading, predefining goals, developing analysis methods, selecting appropriate indicators, and setting risk management regulations are crucial. This allows for systematic trading with minimized losses.

Inadequate Risk Management

Disregarding risk management principles can prove disastrous, leading to a complete loss of the deposit. Aim to invest no more than 1-2% of your capital in a single trade and always set stop losses to curb losses.

Incorporate risk management into your trading journal! Navigate to the "Risk Management" section within your trading journal and adjust the following parameters: - Maximum loss per trade - Maximum loss per day - Maximum leverage Select an API key We will send a notification to your Telegram in case any of your set risk management rules are violated, for this, connect to our bot. 🤖

Over-diversification of Trading Instruments

Rather than trying to trade a wide range of cryptocurrencies, focus on a few and gain a deep understanding of their characteristics. This helps better predict price fluctuations and make more informed projections.

Emotional Trading

Letting emotions dictate your trading decisions can lead to ill-judged and spontaneous actions, heightening the probability of depleting your deposit. Always strive to base your decisions on objective factors and your established strategy, rather than being swayed by fear or greed.

Understanding the Importance of Trade Analysis

The analysis of trades plays a crucial role in the success of crypto trading. Regularly reviewing your trades helps identify weaknesses and opens up possibilities for strategy enhancement. This facilitates learning from past mistakes, leading to improved decision-making in future trades.

Appraising Transaction Success

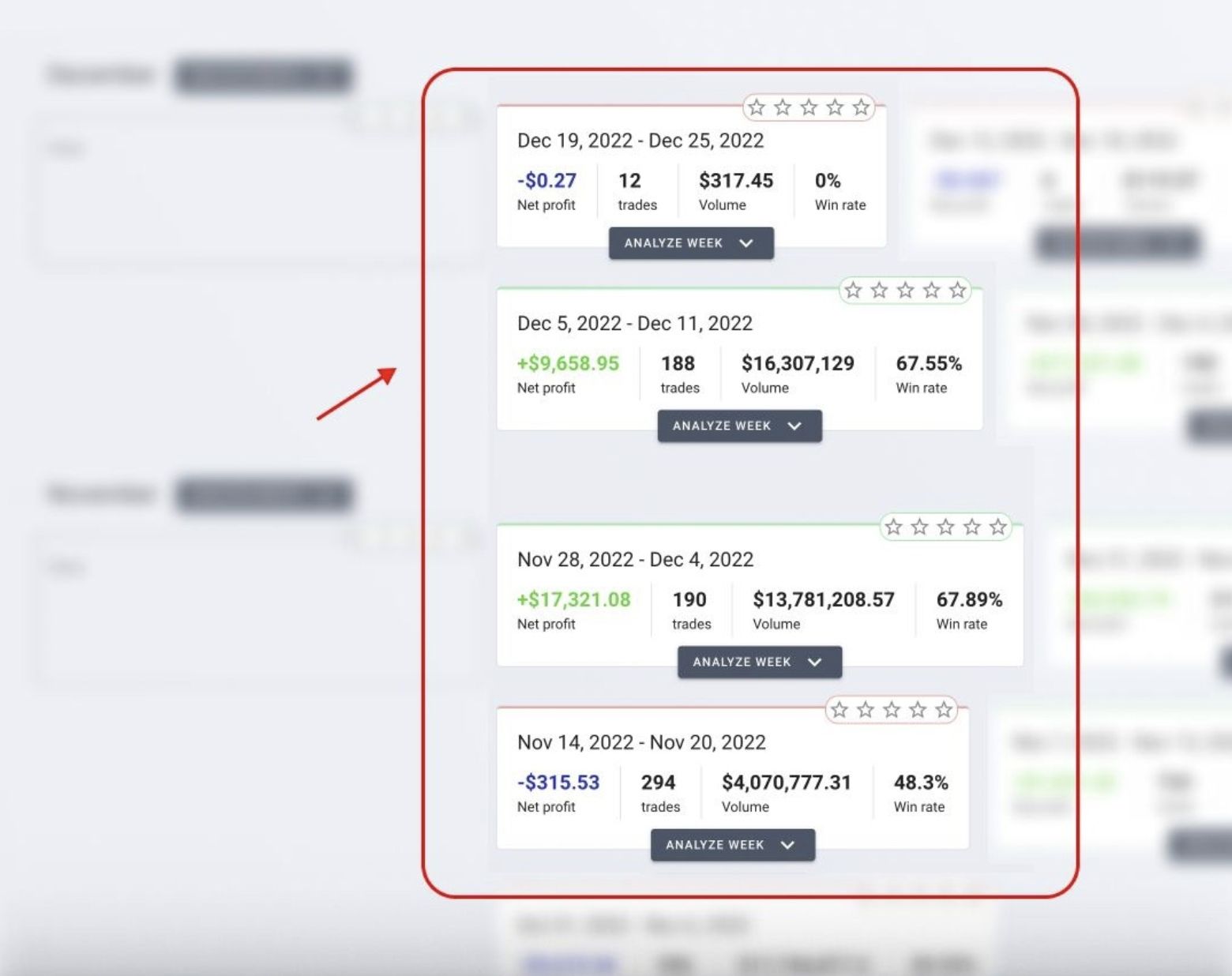

Assess the outcomes of each transaction: identify the successful ones and the ones that didn't meet expectations. This evaluation aids in understanding which methodologies and approaches are effective, and which ones need reconsideration.

Mistakes of crypto traders and their impact on deposit depletion: emphasizing the significance of transaction analysis.

📌 Employ widgets and the "Diary" section for this purpose.

Understanding the Roots of Mistakes

When examining trades that did not go as planned, it is crucial to identify the factors that contributed to the deposit loss. Recognize the errors and deliberate on strategies to prevent them from recurring.

Mistakes of crypto traders and their impact on deposit depletion: underscoring the significance of transaction scrutiny.

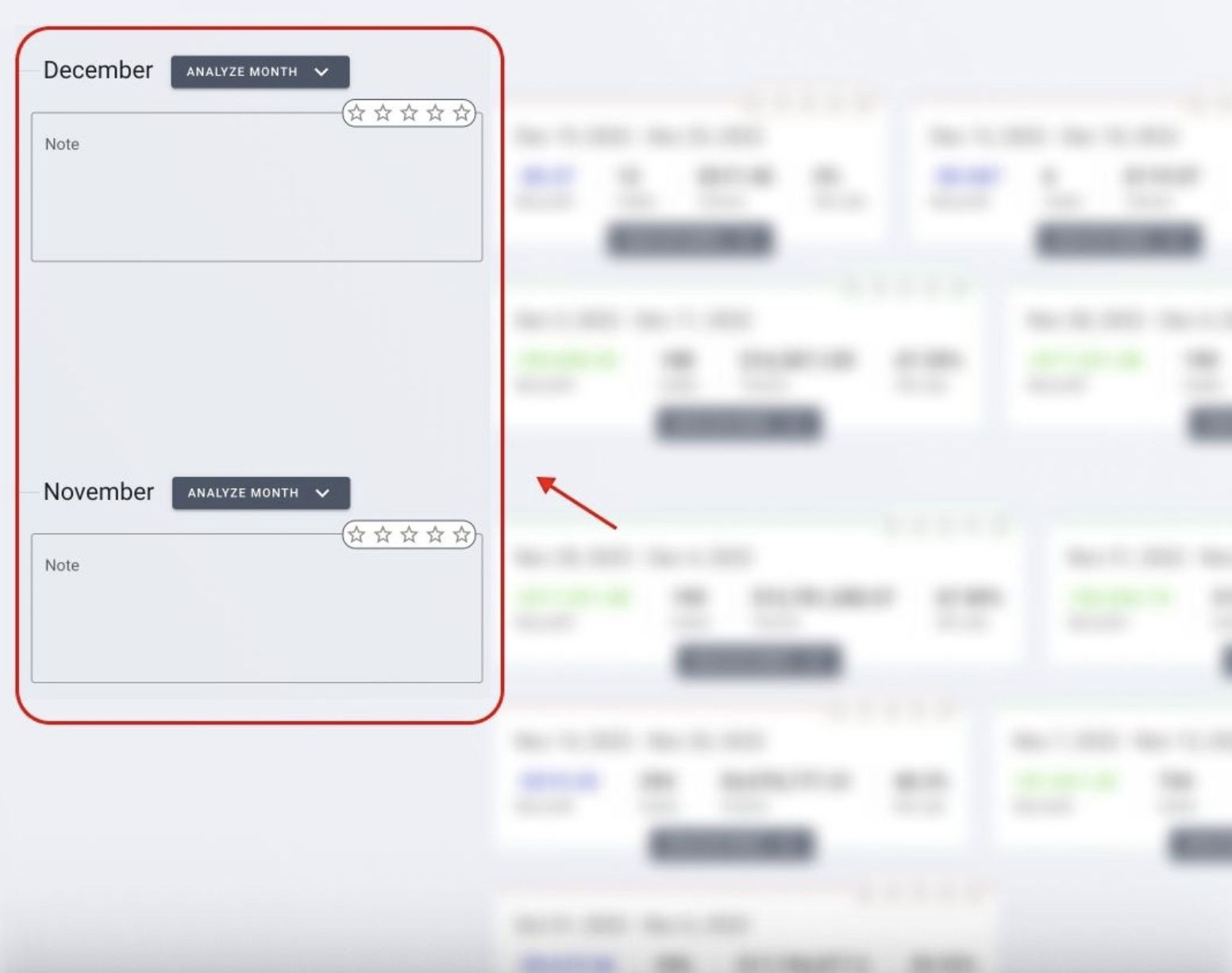

📌 Records are efficiently maintained in Notes, and they are unique for each week, day, and transaction.

Assessing Emotional States

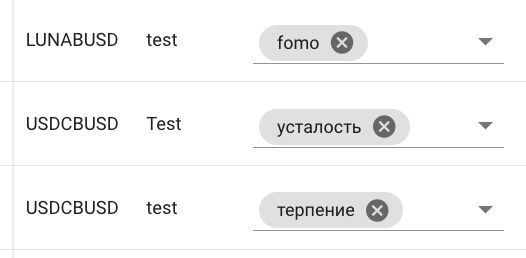

Alongside scrutinizing specific trades, acknowledging the role of emotions in your trading decisions is of paramount importance. If you discern that certain blunders were the outcome of emotional reactions, endeavor to enhance emotional control to foster more logical decision-making.

Mistakes of crypto traders and their impact on deposit depletion: underscoring the significance of transaction scrutiny.

📌 Utilize login reasons to monitor your status.

Trading cryptocurrencies can indeed be a complex and risky endeavor, but by steering clear of habitual errors and routinely assessing trades, you can curtail the risk of depleting your deposit and bolster your chances of successful trading. Commit to learning, evolve your strategies, and practice rational trading, and the results will invariably follow.

It's worthwhile to note that an automated trading journal can significantly aid in analyzing your trading activities. Our Trader Make Money journal autonomously records all your trades, including details like date, time, volume, entry and exit prices, and profit or loss. This enables effortless tracking of your trading history, pinpointing common errors and identifying avenues for strategy optimization.

An automated trading journal can also provide insights into your emotional responses and their effect on your trading. By revisiting trade records, you can recognize decisions driven by emotions and work towards improving your emotional intelligence for more assured and rational trading.

Aim for ongoing progress and a rewarding career in crypto trading! And remember, always keep a record at tradermake.money 💸.