How to Survive While Trading: Tips & Trading Tools

"I have never been afraid of cryptocurrency. But now I am afraid for her. The market scares me. And this fear prevents me from living a normal life: I sleep badly, I hardly eat, my productivity is low... I'm messed up... Sell or hold?"

Did you recognize yourself? 😄

And every 15 minutes in your head the voice sounds: “check the graphs”? And it is obvious that hardly anything has changed since the last check. And it is also understandable that it will not make it easier for you to see the same numbers. But you check them anyway. Because money is at stake. A lot of money.

This article can radically change your trading if you have applied all the following advice. And you can apply them in any market, but in a bear one, you simply cannot live without them. Get out your notebooks and pens, because we have gathered the experience of the coolest crypto trading professionals to tell you how to stay calm when everything is on fire and take out your profits.

The first rule of the crypto traders club: you must always have a plan

It seems so simple and obvious. But this point knocked down most of the traders. Because it is not enough to imagine the general vector of motion in your head. This is not a plan. A plan is a clear, step-by-step guide (ideally written down) for you to follow regardless of emotions and circumstances.

And there is a huge difference between having a plan and sticking to it. Seems, most of you have a rough idea of what they want and how to move there, but in a minute (for example, after reading some "urgent news") you decide to change the plan, and as a result, you sell too early or too late.

📌 You need to set a bunch of criteria. Well-defined rules that you will adhere to when the market goes one way or another. Every professional has a trading plan, and they follow it rigorously.

It's time to think like a pro. Write your trading plan and place it in front of your eyes where you trade. And when the market hits any of the thresholds, all you need is look into your plan and take the action indicated there. If the strategy is written down and is constantly in front of your eyes, it is much more difficult to ignore it.

Guide to action: Ask yourself sometimes, “If the market crashes right now, and I lose everything, will I be fine? "- if the answer is "Yes", keep up the good work. However, if the answer is "No", consider rethinking your approach.

Second rule: strengthen your portfolio

📌 Check your portfolio and separate coins having long-term potential from coins that don't. If the market collapse, it will help you.

It doesn't matter what you invest in, in a bull market - it grows and everyone wins, someone more, someone less.

The bear market is another matter. The ship may not be sinking yet, but it is definitely going through a hard time. And any ballast may drag you down. So help yourself - reduce your deadweight. Analyze your investments, consider the shitcoins - and be thrifty.

It is important to act quickly and decisively this way. Remember, there is real money at stake.

Carefully evaluate even coins having you think long-term potential. And ask yourself: is it worth the risk? And when in doubt, invest your money in a more stable coin that you think can definitely survive the fall.

Guide to action: Add this point to your plan: list all your coins in order of importance, thereby determining in what order you should get rid of them if the market crashes.

Reduce the noise

You have probably heard this advice a lot of times, but nevertheless, you subscribe to the next (thirty seventh) Telegram channel of another “experienced” trader, check Twitter seventh time in a day... And you just can't resist the temptation to discuss another "hot" news in the comments or give advice to that simpleton.

📌 BUT Long-term profitability is always positioning yourself ahead of or behind the crowd and never among the crowd. Stay away from discussions. Everyone in these chats has ulterior motives.

Too many people spend too much time in endless discussions on Telegram / Slack / Twitter / Reddit / Facebook / Discord ... (the list goes on and on). And the best thing you can do is not to visit all these social networks, cause there is too much misinformation spreading there, and this will force you to make rash decisions and sell too early.

Your main (and only) task as a trader is to watch charts and make predictions. And to make accurate predictions, you don't need to collect as much data as you can fit in your head. We are talking only about quality information, there should not be too much of it - it just needs to be suit.

For those of you who want to receive useful information without having to spend a lot of time reading, discussing and most importantly filtering, there is a cool opportunity - to join private (most often paid) chats.

Guide to action: Audit all the sources you follow, clean them up, be critical! Ask yourself - is there really useful information here and does it help me in trading? If not, unsubscribe.

Find your dream team

This technique was invented by a Swedish trader. He wants to intelligently distribute time between his family and his work. And he found a simple but ingenious solution that increased his efficiency 5 times!

📌 He united 5 traders into one team, where the goal of each member is to study 2-3 primary sources of information every day, filter and transmit useful data to the team. Thus, his team always has relevant and only 100% useful information.

Guide to action: Find like-minded people (important!) who you can trust, (even more important!) there should be not many of them. Create a group chat in any messenger you use. Together, select a dozen useful sources and distribute them equally among team members (so that one person has no more than 2 or 3 sources). Every day, each team member must study "their" sources and send the team only information that is important for making trading decisions.

Professional tools

Confucius said: “You give a poor man a fish and you feed him for a day. You teach him to fish and you give him an occupation that will feed him for a lifetime". But fishing will not be very effective if you do not give a person a fishing rod.

So we gonna list a few cool (and useful) tools that can significantly increase the efficiency of your trading (and none of them paid us for ad 😊).

- Trading terminals

I think that most (pro) traders will agree that trading using the exchange interface is extremely inconvenient. And here come trading terminals. They facilitate and speed up the trading process. Today there is a huge number of terminals for crypto trading. First, they are divided into web terminals and software installed on your PC or smartphone, as well as "manual" (for manual trading) and automated. There are a number of criteria to help you choose the best one for you:

- The terminal must have no technical failures. This problem is more common for web terminals. And, if long traders is ok with this, but for scalpers this is the first and most important feature.

- Tools for detailed technical and computer analysis. Important functions are the ability to adjust input parameters, several time periods of charts, work with several financial instruments, etc.

- Customizing the interface. The trading process should be comfortable for a trader, that's why a convenient terminal should provide the ability to change the color of indicators, background, and the chart itself.

- Prompt and accessible technical support, as well as the cost of the trading terminal, are significant factors that make your trading comfortable and cost-effective too. 😆

Among the terminals that meet almost all the above-mentioned requirements are Capico, Finandy (web interface) and CSCALP (PC software).

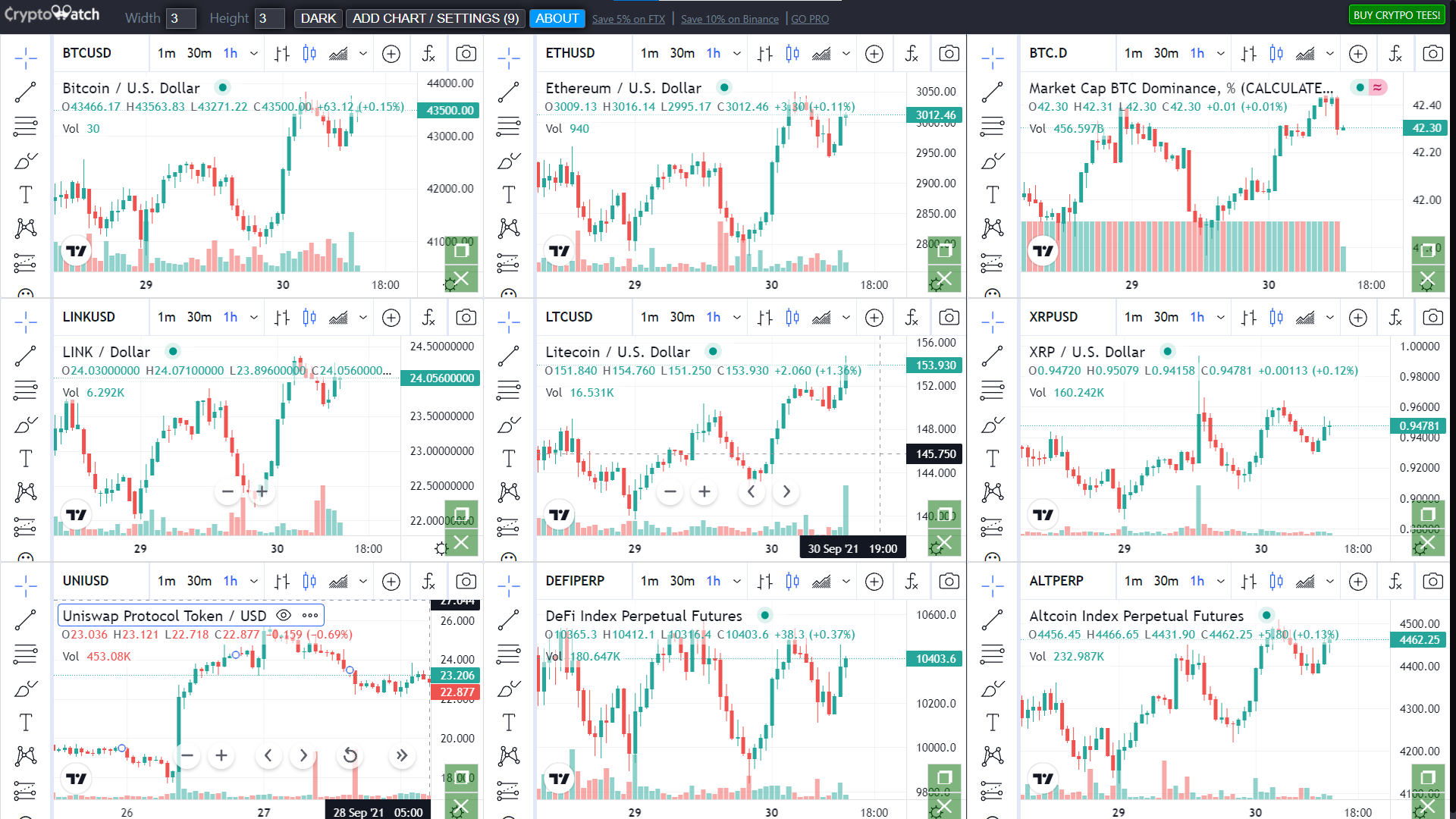

- cryptowatch.net

One of the most essential features of a crypto trader is the ability to simultaneously monitor a lot of charts. And here cryptowatch.net does the best job. This website displays multiple TradingView Charts in 1 Screen, and you can manage separately each of them, as well as choose the ones you need and save your sets of charts. And the coolest part of it is that it's free! 😉

- tradermake.money

It would be silly to miss the chance to remind you about the necessity of analysis, or even about the automation of this process. Tradermake.money is the best trading journal that allows you to add api keys from all your accounts to one log and quickly (transactions are loaded instantly) monitor all statistics in one place. In addition, you can customize the interface as you like (hundreds of metrics, dozens of charts and filters). All data is easy to understand, and you can immediately apply it.

Your trading should not be driven by emotions and gossip, but numbers!

All in all…

Trading is stressful (you know it), but with the right distribution of power, control of emotions, and following the rules, you will be on top.

Hope you found the tips and trading tools helpful.

Love, TMM team!🧡